IHMM Remotely Proctored Exams Available Now

IHMM is pleased to announce that the American National Standards Institute [ANSI] has approved Kryterion Remotely Proctored Exams for IHMM’s CHMM, CHMP, and CDGP exams. IHMM has been using the Kryterion Remotely Proctored Exams for the CSHM and CSMP exams since April of this year.

About 60% of Kryterion in-person testing centers have reopened. If you prefer the comfort and convenience of taking your exam from your home or office instead of at a Kryterion center, IHMM is ready to enroll you in a remotely proctored examination.

Please contact either Kortney Tunstall at [email protected] for the CHMM, CHMP, or CDGP exams or Kaylene Cagle at [email protected] for the CSHM or CSMP exams.

Phone: 301-984-8969 | [email protected]

Tuesday, January 5, 2021

IHMM Today is an online publication of the Institute of Hazardous Materials Management (IHMM)

Other than content specifically provided by IHMM, articles contained in IHMM Today are compiled from independent sources and do not necessarily reflect the opinions of IHMM.

Follow IHMM on Twitter

IHMM UPDATES

The Coronavirus Response and Relief Supplemental Appropriations Act of 2021

A second stimulus is coming for millions of Americans.

The Coronavirus Response and Relief Supplemental Appropriations Act of 2021 – a $900B relief package to deliver the second round of economic stimulus for individuals, families, and businesses was signed into law on December 27, 2020. The bill provides relief through multiple measures and expands many of the provisions already put into place under the CARES Act, including the second round of direct stimulus payments to individuals and families.

Here is what relief is included:

Stimulus Payments for Individuals and Joint Taxpayers

The second wave of direct stimulus payments for millions of Americans – up to $600 for eligible individuals, $1,200 for joint taxpayers, and an additional $600 for each dependent child under 17 – is on the way for millions. This means a family with two children could receive $2,400.

As of today, there is nothing you need to do to get a stimulus payment. The IRS will begin work to issue stimulus payments using the most recent information they have on file, likely from your 2019 tax return, either by direct deposit or by check.

We expect stimulus payments will begin to be sent in the next couple of weeks. We’ll update this post when more information becomes available.

So, how do you know if you may be eligible to receive a second stimulus payment?

If you have an adjusted gross income (AGI) of up to $75,000 ($150,000 married filing jointly), you could be eligible for the full amount of the recovery rebate.

*Note, adjusted gross income (AGI) is your gross income like wages, salaries, or interest minus adjustments for eligible deductions like student loan interest or your IRA deduction. Your AGI can be found online 8b of your 2019 Form 1040.

As your AGI increases over $75,000 ($150,000 married filing jointly), the stimulus amount will go down. The stimulus check rebate will completely phase out at $87,000 for single filers with no qualifying dependents and $174,000 for those married filing jointly with no dependents.

The bill also expands stimulus payments to mixed-status households (households with different immigration and citizenship statuses), meaning more households may be eligible for this stimulus than were for the first round. This may be retroactive, so some individuals that were ineligible for the first stimulus, provided under the CARES Act, may then be eligible to receive that payment as well.

*Note, if you think you may have been eligible for the first stimulus, but didn’t receive it, don’t worry. TurboTax will help you claim your stimulus payment in the form of a recovery rebate credit when you file your 2020 tax return.

Those people receiving Social Security retirement, disability, Railroad Retirement, VA, or SSI income and are not typically required to file a tax return, will again receive a stimulus payment. As in the first round, the IRS would use the information from your Form SSA-1099, Form RRB-1099, or the Veterans Administration to generate your stimulus payment.

Extended Unemployment

Unemployment payments will increase by $300 per week and the benefits will be extended until March 14, 2021.

The bill also extends the Pandemic Unemployment Assistance (PUA), which expands unemployment to those who are not usually eligible for regular unemployment insurance benefits. This means that self-employed, freelancers and side giggers will continue to be eligible for unemployment benefits.

Certain workers who have at least $5,000 per year in self-employment income, but are disqualified from receiving Pandemic Unemployment Assistance because they also have an employer could also be eligible for an additional $100 per week in unemployment benefits.

Special Lookback for Earned Income Tax Credit and the Child Tax Credit

This is a very important provision that has the potential to help workers who experienced lower income in 2020 or received unemployment income in lieu of their regular wages, get bigger tax credits and larger refunds in the coming year.

The special lookback rule will allow lower-income individuals to use their earned income from 2019 to determine their Earned Income Tax Credit and the refundable portion of the Child Tax Credit in 2020, since their lower 2020 income could reduce the amount they are eligible for.

The Earned Income Tax Credit is the country’s largest program for working people with low to moderate-income. More than 25 million eligible tax filers received federal Earned Income Tax Credit last tax season and the average Earned Income Tax Credit was $2,476 per filer.

Expanded Paycheck Protection Program (PPP) for Small Businesses and Eligible Non-Profits

The Coronavirus Response and Relief Supplemental Appropriations Act of 2021, provides a second round of payments under the Paycheck Protection Program.

Self-employed individuals, small businesses, small 501(c)(6) organizations, restaurants, live venues, and EIDL grants will again be eligible. Also, businesses experiencing severe revenue reductions will have the opportunity to apply for a second PPP loan.

Businesses with 300 or fewer employees that have experienced 25% revenue loss in any 2020 quarter and small 501(c )(6) organizations that have 150 employees or fewer would be eligible for a Paycheck Protection Program under the COVID-19 Emergency Relief Package.

The expanded Paycheck Protection Program, also broadens the type of business expenses that can be forgiven under the loan to include supplier costs, will allow business expenses paid utilizing PPP proceeds to be tax deductible, and would simplify the loan forgiveness process.

Contractor Paid Leave

Contractors who were temporarily unable to work due to facility closures and other restrictions could be able to receive reimbursement for paid leave from federal agencies.

Eviction Moratorium and Rental Assistance

The Coronavirus Response and Relief Supplemental Appropriations Act of 2021 extends the moratorium on evictions under the CARES Act, designed to protect renters from eviction, until January 31, 2021.

Families struggling to pay rent or with past due rent could be able to get assistance with paying past due rent, future rent payments, as well as utility bills.

Tax Extenders

The bill includes the permanent passage and, in some cases, multi-year extension of many additional tax provisions – commonly referred to as tax extenders. Tax Extenders provide tax relief and support for families and individuals through various mortgage relief, education, and medical expense relief.

This is a synopsis of tax and related issues in the CARES Act passed by Congress after Christmas. It is not intended to be comprehensive tax advice. For that, consult your tax advisor.

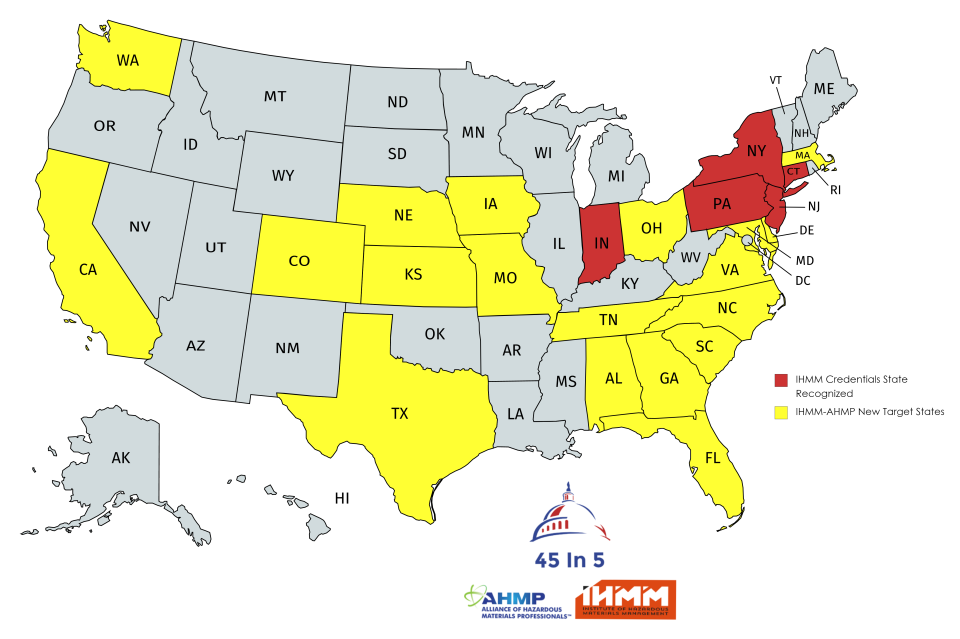

IHMM & AHMP Launch 45 in 5 – National Credential Recognition – 17 States Targeted

On December 15, 2020, IHMM and AHMP gathered the first round of 31 state volunteers to scope out what we need to do and how we need to do it. For their next meeting in January, we begin outlining the strategy to go after 17 states.

This is just the beginning. Here is the present composition of the 45 In 5 Task Force and the states we are focusing on. More people may volunteer anytime! https://ihmm.org/45-in-5-task-force/

In 2019 Mark Bruce from AHMP and Gene Guilford from IHMM worked on a project to get the Commonwealth of Pennsylvania to recognize the CHMM and CDGT credentials. With Mark’s work on the ground in Pennsylvania, we succeeded. We have already succeeded in 5 states.

In the two weeks since the launch, we have added Delaware, Florida, Texas, California, Washington, Georgia, Ohio, Tennessee, Alabama, Maryland, Virginia, Massachusetts, Missouri, Iowa, North Carolina, Colorado, and Nebraska as the next states for us to work on.

Now Mark at AHMP and Gene at IHMM has launched 45 in 5, getting the other 45 states to recognize our credentials in 5 years. If we can find a volunteer like Mark in 45 other states we can work with those volunteers on crafting the right message to the right agencies in state governments across the country. If we find enough volunteers we can get this done in less than 5 years.

Here’s what we ask each volunteer to do:

- Take a template letter we write and send it to the right people at the right agencies of state governments

- IHMM & AHMP will identify the agencies and the people to contact

- Follow up after sending the letter

- IHMM will engage all of our certificants and AHMP will engage all of its members in each state to communicate with the agencies in support of the recognition

Let’s get the rest of the country on board. Volunteer using this form > https://forms.gle/xVJ7UgwcfomWTpdR9

ISO/PAS 45005:2020(en) Occupational health and safety management — General guidelines for safe working during the COVID-19 pandemic

ISO (the International Organization for Standardization) is a worldwide federation of national standards bodies (ISO member bodies). The work of preparing International Standards is normally carried out through ISO technical committees. Each member body interested in a subject for which a technical committee has been established has the right to be represented on that committee. International organizations, governmental and non-governmental, in liaison with ISO, also take part in the work. ISO collaborates closely with the International Electrotechnical Commission (IEC) on all matters of electrotechnical standardization.

IHMM is a member of ASSP and is pleased to bring this information to all of our certificants. IHMM further wishes to recognize and thank the hard work of Thomas J. Slavin, CSHM, who made significant contributions to this work. Well done Tom.

Read more here.

IHMM News Recent Updates

State tax law changes that took effect on January 1, 2021

FMCSA Notice of Proposed Regulatory Guidance; HOS and Yard Moves

EPA Publishes Final Risk Evaluation for Asbestos, Part 1: Chrysotile Asbestos

EPA Releases Final TSCA Section 6(h) Rules for Five PBT Chemicals

OSHA Reminds Specific Employers to Submit Required 2020 Injury and Illness Data by March 2, 2021

Two new NIOSH web pages posted on respiratory protection activities

EPA Intends Proposed Rule to Increase Flexibility and Reduce Burdens under TSCA Fees Program

Addendum to the 62nd Edition of the IATA DGR

Michael Regan, Biden’s E.P.A. Pick

Piepline Safety Update, Dewcember, 2020

Mission Critical: Identifying Hazards in Non-Routine Work, Maintenance and Emergencies

EEOC Provides Shot in the Arm to Employers with Long-Awaited Guidance on COVID Vaccines

DOL Issues Opinion Letters Regarding Pay Calculations for Teleworkers, In-Home Caregivers

$20 Million U.S. TSCA/Lead-Based Paint Penalty: Expensive Reminder to Manage and Audit Contractors’ Joint Regulatory Liabilities

HMS UPDATES

End Of The Year Donations

End Of The Year Donations

One of the most important projects of the Hazardous Materials Society is our Scholarship program.

HMS wants to make it as easy as possible for those who cannot always afford to participate in pursuing certification, or keeping up with professional development, or attending great conferences and receiving outstanding training. HMS does not solicit contributions from the general public. HMS does ask IHMM’s certificants and their companies and our education and training vendors to consider a contribution.

Here, through your generosity, you can make a difference in promoting the ability of those who can afford it least to become participants in our communities of practice.

It’s never too late to make a difference, so don’t let this opportunity to make a difference pass you by. Please consider a tax-deductible donation of $250, $500 or what you can to help build HMS’s effort to help others in our communities of practice.

HMS Education and Training

Hazardous Materials Society now has 18,415 education and training programs on its website https://hazmatsociety.org/education-training/ with more coming every week. Certificants will note that most of these programs carry a CMP value, making it easier to know in advance what to expect. The HMS Education and Training platform also provides a wide variety of courses for professional development across all of IHMM’s credentials – and more are being developed by the HMS Education and Training Committee.

This is the center of education and training for IHMM certificants and prospective certificants. Among these more than 15.000 programs are webinars delivered online and virtually all carry IHMM CMPs values with them for your annual / 5-year CMP planning. SEE: https://hazmatsociety.org/education-training/

HMS Affinity Programs – Meritain Health Insurance

HMS Affinity Programs – Meritain Health Insurance

With more than 27,000 people – here is where HMS leverages our numbers for member’s benefit. There is strength and value in numbers and that translates into lower costs for you.

Haven’t you had enough of the health insurance industry/government exchanges run-around where you have few if any, choices and ever-increasing costs?

HMS has worked with the best people in the health insurance industry to deliver a program exclusively for HMS members that solves this problem. The HMS Health Insurance Program empowers our small to medium-sized businesses with stronger coverage at a lower cost than is found in the ACA commercial marketplaces where you get insurance today.

IHMM/HMS Coronavirus Resources

IHMM/HMS Coronavirus Resources

In February of 2020, the World Health Organization’s director-general has declared a public health emergency of international concern over the ongoing outbreak of respiratory illness caused by a novel coronavirus. On March 13, 2020 President Trump declared a national emergency for the United States. IHMM and HMS’ first concern is with the safety and health of all of us; our staff and families, colleagues, certificants and members. We will update this page regularly as credible, authoritative information is available.

INFORMATION FOR HEALTHCARE PROFESSIONALS, PUBLIC HEALTH PROFESSIONALS, AND LABORATORIES.

HMS Launches Jobs Board

We invite our participating companies to post their available employment opportunities here. There is no charge for this service. HMS staff reviews each proposed posting for clarity and completeness before posting to the public view and may remove a posting without notice.

Member Benefits of Hazardous Materials Society

Member Benefits of Hazardous Materials Society

81% of IHMM certificants are aware of the Hazardous Materials Society, which we appreciate. IHMM established the Hazardous Materials Society in order to support and provide services to IHMM certificants.

Did You Know?

Your company’s membership dues for Associate Membership in the Hazardous Materials Society (HMS) are 100% tax-deductible and your participation directly supports scholarship and education/training opportunities for professionals working in hazmat and EHS. Joining as an Associate Member expresses your commitment and your company’s leadership in giving back to our professional community. Join today to claim your tax deduction for the 2020 tax year while expressing your company’s professional affiliation and accessing tools for your marketing and business development plans.

To learn more about what HMS is doing now and what they are planning for the future, please see the new Member Benefits page here.

Free Virtual Hazmat Audit With Hazmat Training Purchase!

- Hazmat & Dangerous Goods Training – DOT, IATA, IMDG, TDG, ADR

- OSHA Safety Training

- Driver Safety Training

- This Training Can Be Customized To Your Operations

- SCORM, TIN CAN, AICC, CMI5 Compliant Training Options

A Collaborative Culture

There are 293 different conversations going on in the IHMM/HMS Collaboration platform this week. A collaborative culture is important for every business but is especially important for our hazardous materials, dangerous goods, environment, health, and safety communities of practice. IHMM credentialed professionals are at the top 1% of their professions and their reach is global. We are at the forefront of environmental protection, health, and safety and this is where collaborating with the best people in their fields, always willing to help one another, lessens the stress of our jobs and where we strive as a team to make a difference of which we are proud.

There are 293 different conversations going on in the IHMM/HMS Collaboration platform this week. A collaborative culture is important for every business but is especially important for our hazardous materials, dangerous goods, environment, health, and safety communities of practice. IHMM credentialed professionals are at the top 1% of their professions and their reach is global. We are at the forefront of environmental protection, health, and safety and this is where collaborating with the best people in their fields, always willing to help one another, lessens the stress of our jobs and where we strive as a team to make a difference of which we are proud.

We opened COLLABORATION to enable thousands of certificants and supporters to collaborate together. You can collaborate here> https://community.ihmm.org/home

Global leadership in DG compliance

Hazmat Safety Consulting provides dangerous goods services to assist clients navigate the complexities of the dangerous goods regulations for all modes of transport. Our staff all previously worked for the US DOT, and have international regulatory experience and knowledge to address the most challenging dangerous goods issues. For clients, a partnership with HSC means having access to knowledgeable consultants that will give you peace of mind that your DG shipping program is operating in a safe and efficient manner.

|

Retiring? IHMM Invites You to Become an Emeritus

You may have decided, after a long and successful career, to retire from active daily duty. Congratulations. That doesn’t mean you have to completely disengage from your profession. IHMM is pleased to offer Emeritus status to all certificants who will no longer be actively engaged in their communities of practice but who still want to stay in touch. Please let us know when you’re approaching that decision and we will assist you in the credential transition. Please contact Jim Drosdak at [email protected] and he’ll be happy to help you.

Columbia Southern University

The Hazardous Materials Society [HMS] is a partner of Columbia Southern University. Columbia Southern University is an online university based in Orange Beach, Alabama, that strives to change and improve lives through higher education by enabling students to maximize their professional and personal potential.

A subsidiary of Columbia Southern Education Group, CSU offers online degree programs at the associate, bachelor, master, doctorate or certificate levels in a multitude of areas such as occupational safety and health, fire administration, criminal justice, business administration, human resource management, health care administration and more. CSU also features undergraduate and graduate certificate programs to provide focused training in specialized areas for adult learners.

Click on the CSU graphic at left and learn more about the professional development and degree program opportunities at CSU.

IHMM is a member of the National Safety Council and is pleased to bring this important information to all of its certificants.

Rising Stars of Safety, Class of 2020

Respirator fit test requirements

OSHA’s General Duty Clause

The future of safety

NFPA 70E: Five key revisions for 2021

What’s ahead for OSHA?

Welcome to the Hybrid Workplace

Where you can reach, engage, and inform employees with ease—whether they’re on-site, at remote locations, or on the go.

Lessons Learned During the Pandemic

Many lessons were learned throughout 2020—especially among businesses that saw employee communication and engagement gaps that threatened everything from COVID-19 safety measures to overall productivity, morale and so much more. See exactly what’s at stake when the key component of a successful hybrid workplace—communication—isn’t given the attention it deserves.

IHMM CONFERENCES FOR 2021

IHMM will attend and support a number of conferences and trade shows throughout 2021, virtually as well as in-person as COVID issues allow. Below are the first few conferences we have coming up early in 2021.

National Safety Council Congress & Expo, March 1-5, 2021

National Safety Council Congress & Expo, March 1-5, 2021

For more than 100 years, safety, health and environmental professionals have turned to this safety event for industry-leading technology, education, networking opportunities and the tried and true products and services needed to stay at the forefront and remain competitive within the industry. We are excited to offer the NSC Safety Congress & Expo virtually while also prioritizing the safety of stakeholders during this pandemic environment.

Until we can meet face-to-face, it’s a convenient and affordable way to deliver quality educational programs and safety solutions directly to you. It’s the perfect place to come together to share experiences, to learn new ways of doing business, and explore the innovations that will drive our industry to save lives, from the workplace to anyplace.

- A community platform to network, share lessons learned and plans for the future

- A live and on-demand education platform for safety teams around the world

- A trade show just like an in person expo hall to see innovations and make connections to grow sales and profitability

The cumulative experiences and learning offered are the difference between making the journey to a safer workplace and arriving at the destination, helping safety professionals get to the finish line and achieve their goals. In the fast-changing workplace, we keep you ahead of the curve.

Mark your calendars, March 1-5, 2021!

REGISTRATION

Ohio Safety Congress & Expo 2021

March 10-11, 2021

This year we’re offering online learning sessions and a digital expo, allowing participants to learn remotely and chat virtually with presenters and exhibitors.

As always, attendance is FREE, and registration for the virtual event opens in December.

COSTHA 2021 Annual Forum

April 2021

Greenville, South Carolina

This event is expected to be run entirely virtually.

IHMM GOVERNMENT AFFAIRS

Congress Passes New COVID-19 Relief Legislation

On the evening of December 21 and the morning of December 22, the Congress passed and sent to the President fiscal year 2021 appropriations to fund the federal government as well as new provisions for COVID-19 relief. The President signed that legislation on December 27, 2020.

You may read more here >> https://rules.house.gov/sites/democrats.rules.house.gov/files/BILLS-116HR133SA-RCP-116-68.pdf

The synopsis of this new law is found below.

Provisions of the Coronavirus Aid, Relief, and Economic Security (CARES) Act Coronavirus Relief Fund (CRF)

After an eight-month, stop-and-start test of endurance, Congress passed a $900 billion COVID-relief and $1.4 trillion government funding package that gives critical pandemic aid to Americans, while securing federal agency operations through September 2021. While no additional state and local aid was provided, an extension of the deadline by which the Coronavirus Aid, Relief, and Economic Security (CARES) Act Coronavirus Relief Fund (CRF) resources must be spent was extended to Dec. 31, 2021.

The mammoth measure, which the president signed into law on Dec. 27, will provide another round of direct payments, enhanced unemployment benefits, education funding, and aid to sectors still reeling from the economic fallout of the pandemic.

Citizens

- Direct economic relief via stimulus checks of $600 for individuals making up to $75,000 per year. $1,200 for couples making up to $150,000, and an extra $600 for dependent children that are under 17 years old.

- It would apply the similar income limits and phase-out as the CARES Act, reducing the payments by 5% for individuals with adjusted gross incomes of more than $75,000. Filers with an adjusted gross income (AGI) greater than $87,000 (or $174,000 if filed jointly) would not receive a payment.

- Payments would be based on 2019 taxes. Payments could be issued for certain beneficiaries who did not file 2019 returns, including retired and disabled workers, Supplemental Security Income recipients, and veterans receiving VA benefits.

Tax Provisions

- Payroll Tax Deferral: Workers whose payroll taxes have been deferred since September would be given until Dec. 31, 2021, to pay back the government, instead of through April 30, 2021, as originally directed by the Treasury Department.

- Paid Leave Credits: The measure would extend credits for paid sick and family leave provided under the second coronavirus relief package through March 31, 2021.

Expanded Unemployment Benefits

- Provides $120 billion in unemployment insurance (UI).

- Extends the Federal Pandemic unemployment Compensation (FPUC) program through March 14, 2021, providing $300 per week for all workers receiving unemployment benefits.

- Extends and phases out the Pandemic Unemployment Assistance (PUA) to March 14 (after which no new applicants) through April 5, 2021.

- Extends and phases out the Pandemic Emergency Unemployment Compensation (PEUC), which provides additional weeks when state unemployment runs out, to March 14 (after which no new applications) through April 5, 2021.

- Provides additional weeks for those who would otherwise exhaust benefits by increasing weeks available from 13 to 24–with all benefits ending April 5, 2021.

- Increases the maximum number of weeks an individual may claim benefits through regular state unemployment with the additional PEUC program, or through the PUA program, to 50 weeks.

- Provides an additional $100 per week for certain workers who have both wage and self-employment income but whose UI benefit calculation does not take their self-employment into account.

- Extends the interest-free loans to states, flexible staffing and nonprofit relief to March 14, 2021.

- Requires documentation of employment, rather than the self-certification that is currently in use and requires states to verify applicant identity.

- Requires states to have a place to report when someone turns down a job and must notify claimants of the requirement to accept suitable work.

- States may opt to provide an extra benefit of $100 per week for up to 11 weeks through March 14, 2021, for certain workers who have both wage and at least $5,000 of self-employment income in most recent taxable year ending prior to application.

Other Labor Provisions

- The Families First Coronavirus Response Act (FFCRA) provided a refundable tax credit for the mandated paid sick leave and family leave for private-sector employers with under 500 employees:

- This bill extends the tax credit through March 31, 2021, for employers that continue to offer paid sick and family leave to their employees.

- The bill does not extend the FFCRA provisions that required the public sector employers (state and local government entities) to provide emergency paid sick and family leave.

- The unfunded federal mandate for state governments to provide emergency paid sick and family leave is still set to sunset on Dec. 31, 2020.

- The bill does allow private sector employers and self-employed individuals to claim the tax credit for voluntarily providing emergency paid leave that is provided through March 31, 2021

- Extends and expands the CARES ACT employee retention tax credit (ERTC).

- Beginning on Jan. 1, 2021, and through June 30, 2021, the provision does the following:

- Increases the credit rate from 50% to 70% of qualified wages.

- Expands eligibility for the credit by reducing the required year-over-year gross receipts decline from 50% to 20% and provides a safe harbor allowing employers to use prior quarter gross receipts to determine eligibility.

- Increases the limit n per-employee creditable wages from $10,000 for the year to $10,000 for each quarter.

- Increases the 100-employee delineation for determining the relevant qualified wage base to employers with 500 or fewer employees.

Small Business Provisions

- Provides $325 billion in small business funds.

- $284.5 billion for first and second forgivable Paycheck Protection Program (PPP) loans.

- A small business can receive a second PPP loan if they have less than 300 employees and can demonstrate a revenue reduction of 25%.

- Maximum loan amount reduced to $2 million.

- $20 billion for new Economic Injury Disaster Loan Grants for businesses in low-income communities.

- $15 billion in funding for live venues, independent movie theaters, and cultural institutions.

- $3.5 billion for continued Small Business Administration debt relief payments.

- $2 billion for enhancements to Small Business Administration lending.

- $284.5 billion for first and second forgivable Paycheck Protection Program (PPP) loans.

- Businesses that received PPP loans would be able to take tax deductions for the expenses covered by forgiven loans.

- Expands PPP eligibility for 501 (C)(6) nonprofits, including local newspapers, radio, and television broadcasters, and destination marketing organizations.

- Provides $12 billion for Community Development Financial Institutions and Minority Depository Institutions that provide credit and financial services to low-income and minority communities.

CHEMTREC’s Online Hazmat Training Meets U.S. DOT Training Requirements!

CHEMTREC, the world’s leader in hazmat emergency response, can help keep your company safe and compliant with its self-paced online hazmat training courses. Available training includes 49 CFR, Hazmat General, Safety and Security Awareness, IATA, and Lithium Battery Shipping. Sign up today!

IHMM EVENTS CALENDAR

IHMM NOW HAS A COMPANION ORGANIZATION FOR WHICH EDUCATION AND TRAINING PROGRAMS ARE PRESENTED AND DELIVERED. THE CALENDAR IN THIS SPACE FROM THE IHMM WEBSITE IS BEING REPLACED BY THE HAZARDOUS MATERIALS SOCIETY WEBSITE AND THE EDUCATION AND TRAINING SECTION FOUND HERE: https://hazmatsociety.org/education-training/

9210 Corporate Boulevard, Suite 470, Rockville, Maryland, 20850

www.ihmm.org | [email protected]

Phone: 301-984-8969 Fax:301-984-1516

IHMM/HMS Coronavirus Resources

IHMM/HMS Coronavirus Resources

National Safety Council Congress & Expo, March 1-5, 2021

National Safety Council Congress & Expo, March 1-5, 2021