On August 8, 2020 IHMM reported on four [4] Executive Orders signed by the President. One of these Executive Orders allowed for a deferral of payroll taxes.

As a result of the President’s Executive Order of August 8, 2020, the Administration and Congress need to come together on a path that provides much-needed tax relief for families without the uncertainty associated with the recent payroll tax Executive Order (EO).

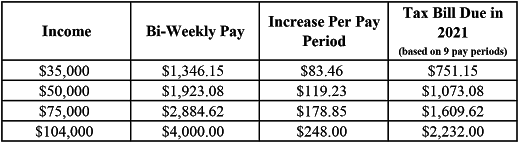

Under current law, the EO creates a substantial tax liability for employees at the end of the deferral period. Without Congressional action to forgive this liability, it threatens to impose serious hardships on employees who will face a large tax bill as a result of deferral. The following chart demonstrates the magnitude of the potential tax bill compared to the immediate benefit of deferral.

If this were a suspension of the payroll tax so that employees were not forced to pay it back later, implementation would be less challenging. But under a simple deferral, employees would be stuck with a large tax bill in 2021. Many consider it unfair to employees to make a decision that would force a big tax bill on them next year. It would also be unworkable to implement a system where employees make this decision. Therefore, many will likely decline to implement deferral, choosing instead to continue to withhold and remit to the government the payroll taxes required by law. We hope Congress and the Administration come together on a path that supports workers instead of burdening hardworking Americans with a large tax bill next year.

President’s Payroll Tax Deferral Executive Order >> https://www.whitehouse.gov/presidential-actions/memorandum-deferring-payroll-tax-obligations-light-ongoing-covid-19-disaster/